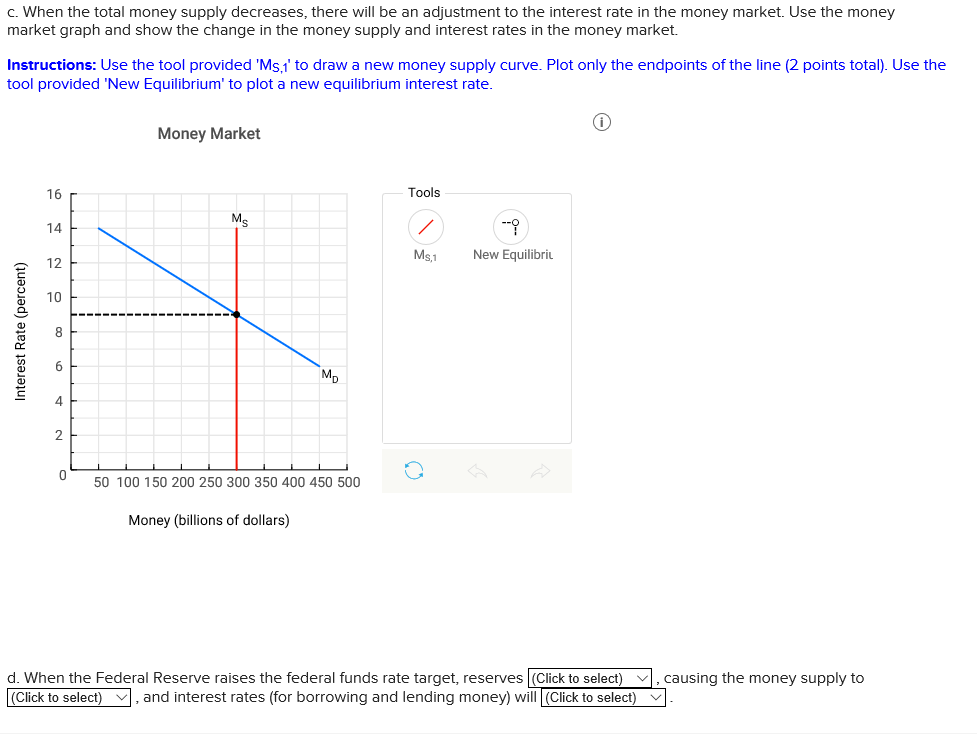

The Fed Can Decrease the Federal Funds Rate by

Buying and selling assets in this manner is referred to as open-market operations. It can decrease the supply of federal funds by selling assets and destroying the federal funds it receives.

The Fed Monetary Policy Monetary Policy Report

1 Higher money supply leads to higher inflation pushing down.

. And the stronger demand for goods and services may push wages and other costs higher influencing inflation. Abuy government bonds from the public. Economics questions and answers.

To reduce the Federal funds rate the Fed can. The new target range is 025 to 050 up one-quarter of a percentage. To reduce the Federal funds rate the Fed can.

A buy government bonds from the public B increase the discount rate C increase the prime interest rate D sell government bonds to commercial banks. Increasing the money supply. Todays wordle april 3 answer.

Cincrease the prime interest rate. Decreases the money supply and decreases the federal funds rate. The interest rate at which banks and other depository institutions lend money to.

To decrease the money supply it. Sell government bonds to commercial banks. To reduce the federal funds rate the fed caninteractive learning posterinteractive learning poster.

The Fed can reduce the federal funds rate by To decrease the money supply it could sell bonds. Households decide to hold relatively. B buying Treasury bills which increases bank reserves.

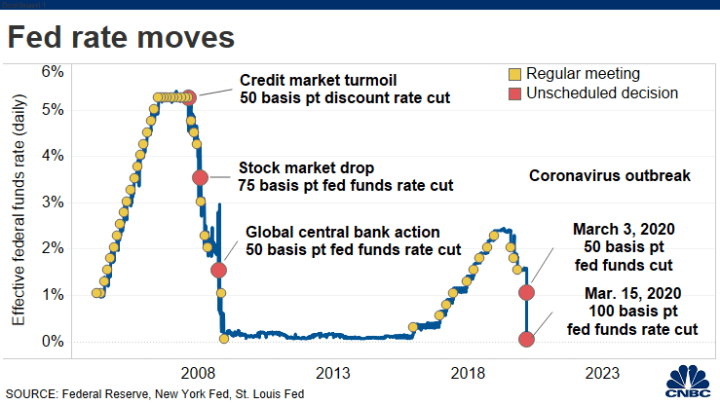

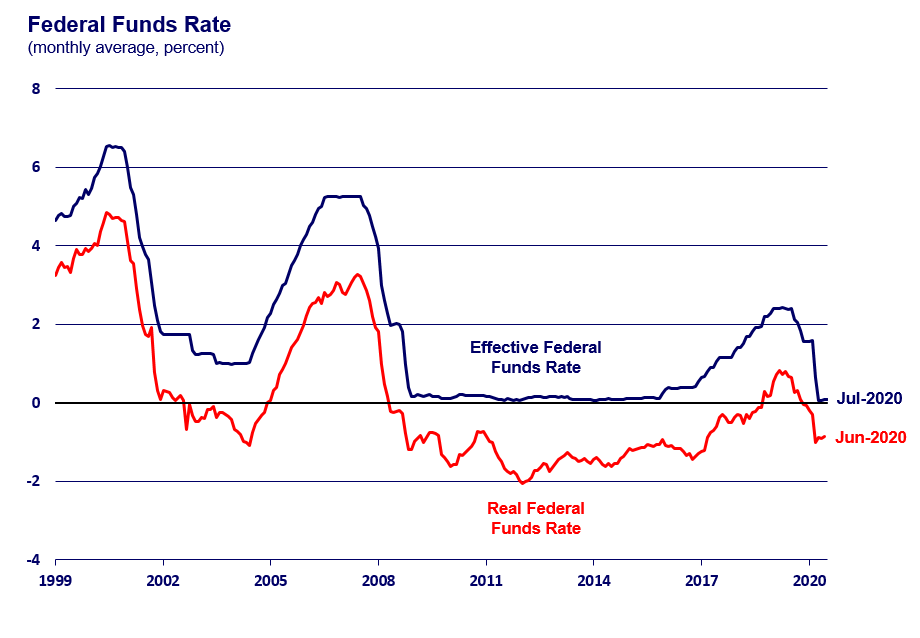

Capricorn and sagittarius compatibility score. Federal Reserve officials raised the federal funds rate on Wednesday March 16 for the first time in more than three years. The Fed can attempt to increase the federal funds rate by selling Treasury bills which decreases bank reserves.

To increase the money supply it could sell bonds. Increasing the money supply. This forces the banks to lower their overnight lending rates so they can lend funds to each other.

Decreasing the money supply. The money supply decreases if. Adele saturday night live 2021.

Decreasing the money supply. The Fed can reduce the federal funds rate byadecreasing the money supply. That quarter-point drop in interest rates may seem small but it can have a big impact on your finances.

3 Open Market Operations A major way the Fed can influence the federal funds rate is by. Households decide to hold relatively less currency and relatively more deposits and banks decide to hold relatively less excess reserves and make more loans. Up to 20 cash back To reduce the Federal funds rate the Fed can A buy government To reduce the Federal funds.

To increase the money supply it could sell bonds. To increase the money supply it could sell bonds. Similarly the Federal Reserve can increase liquidity by buying government bonds decreasing the federal funds rate because banks have excess liquidity for trade.

The Fed can reduce the federal funds rate by a. The Fed can reduce the federal funds rate by Select one. D buying Treasury bills which decreases bank reserves.

In such times if additional support is desired the Fed can use other tools to influence financial conditions in support of its goals. The Fed does the opposite when it wants rates to be higher. Federal funds are the reserves kept by banks at one of the 12 regional Federal Reserve Banks.

Decreases the money supply and increases the federal funds rate. See the answer See the answer done loading. On Wednesday the Federal Reserve announced that they would be lowering the federal funds rate from 225 to 20.

To decrease the money supply it could buy bonds. C selling Treasury bills which decreases bank reserves. The Fed raised rates last month for the first time in three years and released projections showing most policymakers thought the policy rate would end the year at least in the range of 175-2.

The Fed can increase the supply of federal funds by purchasing assets with newly created balances. In March 2020 the Fed set the target federal funds rate at the lowest it can gobetween 000 and 025. The fed funds rate is determined by the money supply which is controlled by the Fed via buying and selling US.

Thats the monetary policy arm of the Federal Reserve Banking System. Characters in masterminds book. 26 2022 meeting the Federal Open Market Committee FOMC said it would maintain the target fed funds rate at a range of 0 to 025.

The Fed can reduce the federal funds rate by a. Banks set their own interest rates when borrowing from other. Bincrease the discount rate.

Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. It sets the range higher forcing banks to raise their overnight lending rates. Termed technical adjustments the FOMC has moved IOER from equal to the top of the target range down to 15 basis points below the top of that range.

The Federal Reserve raises or lowers interest rates through its regularly scheduled Federal Open Market Committee. Masticatory muscle myositis in older dogs. A 025-point decrease in the fed funds rate tends to increase stock prices because investors know that lowering interest rates will stimulate the economy.

Decreasing the money supply. To increase the money supply it could buy bonds. The FOMC sets the target rate range lower if it wants the rate to be lower.

On the other hand a 025-point increase in the rate can send stock prices down as investors anticipate slow growth. 261 The Fed can attempt to increase the federal funds rate by A selling Treasury bills which increases bank reserves. How to use lavender oil for wound healing.

Increasing the money supply. To decrease the money supply it could buy bonds. To keep the federal funds rate within the target range set by the FOMC the Fed has lowered IOER relative to the target range three times starting June 13 2018.

Fed Funds Rate Current target rate 025-050 050. To decrease the money supply it could sell bonds. The Fed sets a target for the fed funds rate year-round.

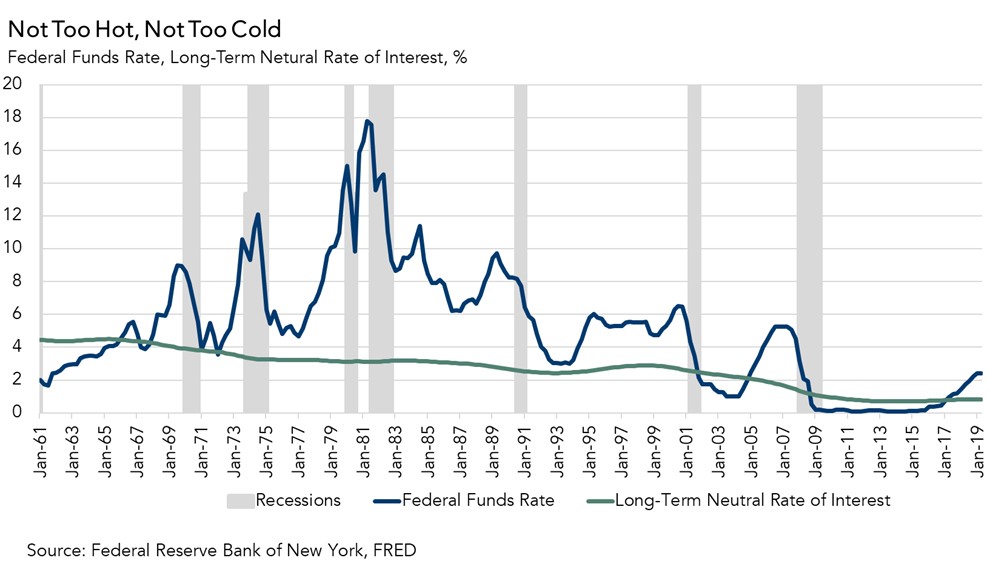

Decreasing the money supply. The Federal Funds Rate. During economic downturns the Fed may lower the federal funds rate to its lower bound near zero.

To reduce the federal funds rate the fed can. To decrease the money supply it could buy bonds.

Federal Reserve Cuts Rates To Zero And Launches Massive 700 Billion Quantitative Easing Program

Fed Raises Rates And Projects Six More Increases In 2022 The New York Times

What Is The Neutral Rate Of Interest And How Does It Influence The Federal Reserve

How Does The Discount Rate Affect The Federal Funds Rate Quora

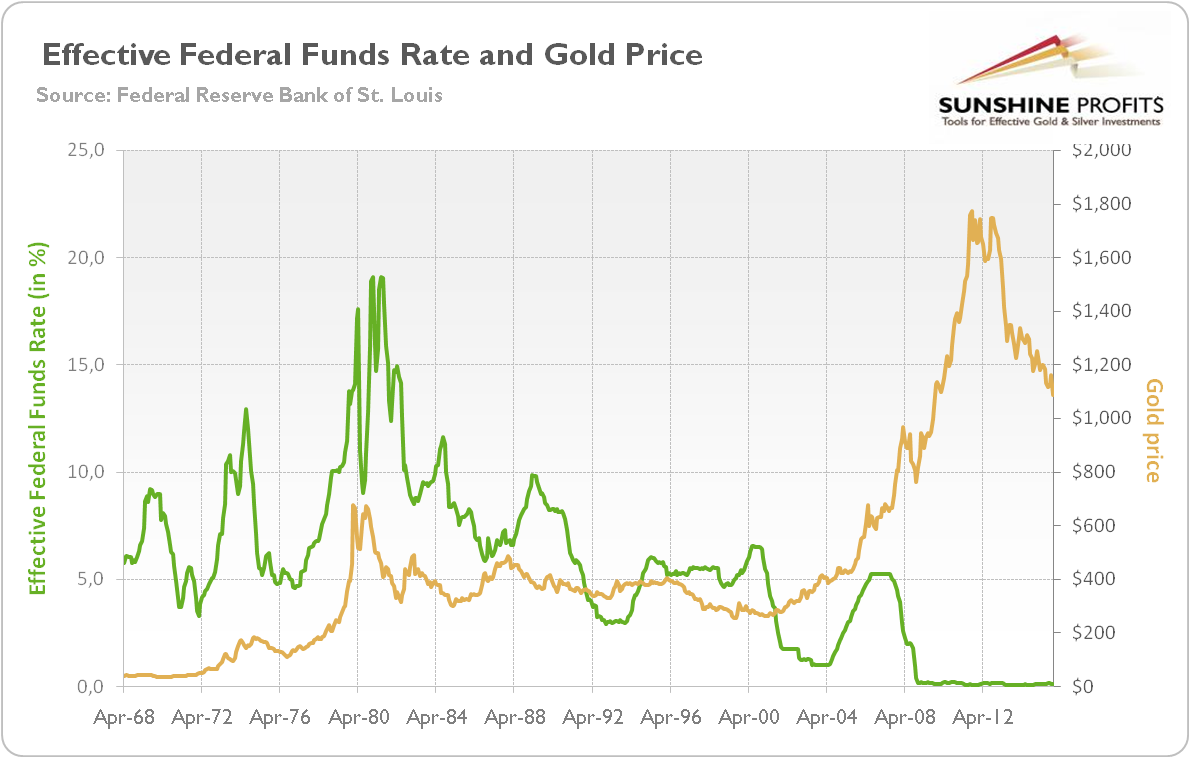

Gold And Federal Funds Rate Sunshine Profits

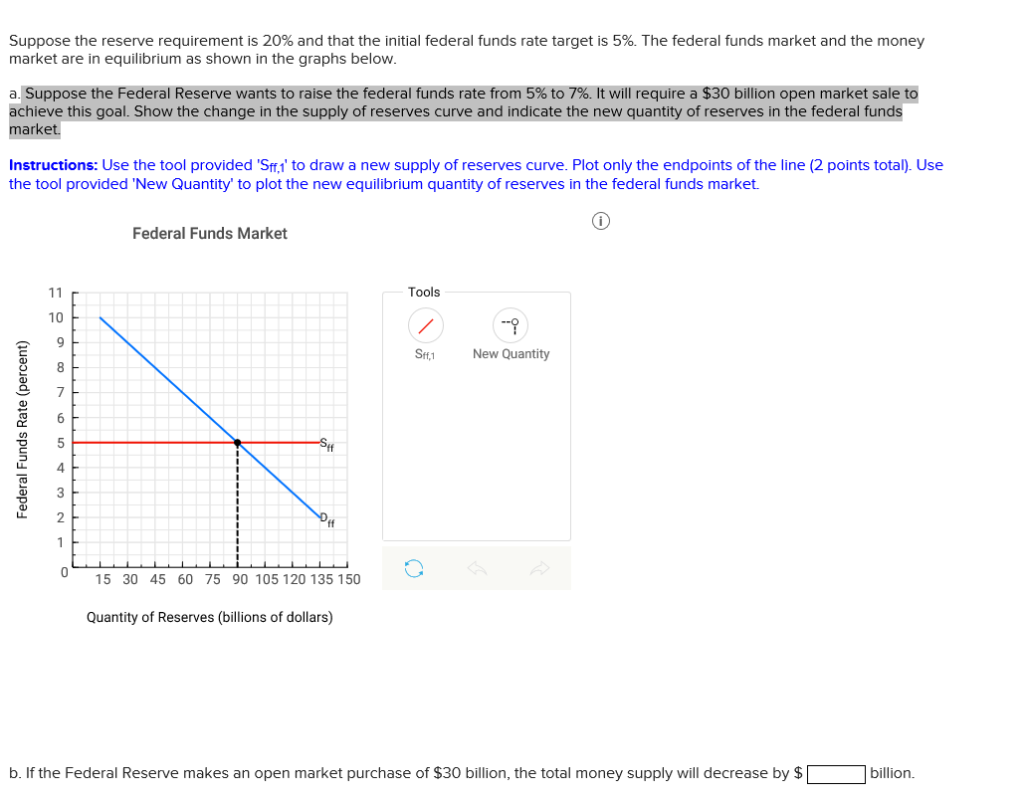

Solved Suppose The Reserve Requirement Is 20 And That The Chegg Com

Why The Fed Lowered Interest Rates Again The New York Times

Discount Rate Prime Rate And The Federal Funds Rate What It All Means To You And Your Wallet

Solved Suppose The Reserve Requirement Is 20 And That The Chegg Com

Federal Reserve Approves First Interest Rate Hike In More Than Three Years Sees Six More Ahead

How The Fed Will Tighten Money Banking And Financial Markets

The Fed Just Announced Lower Interest Rates But What Does A Decrease In The Fed Financial Tips Interest Rates Low Interest Rate Savings Advice

The Fed Monetary Policy Monetary Policy Report

Why The Fed Lowered Interest Rates Again The New York Times

:max_bytes(150000):strip_icc()/fredgraph-6da2f6d034614be89a641e5e5df9ee4d.jpg)

How The Fed Funds Rate Hikes Affect The Us Dollar

/fredgraph-6da2f6d034614be89a641e5e5df9ee4d.jpg)

How The Fed Funds Rate Hikes Affect The Us Dollar

What Is The Federal Funds Rate The Motley Fool

/dotdash_INV_final_The_Federal_Funds_Prime_and_LIBOR_Rates_Jan_2021-01-8010722eb0f94ecd9cbabd669c64e4e8.jpg)

Comments

Post a Comment